Background

Our client is a UK-based startup that has developed an innovative mobile application to help users take full control of their finances. The app is for people who struggle to track their finances across multiple bank accounts and cards. The app should centralize financial information, provide users a convenient way to monitor their spending, and use advanced AI technology to offer personalized recommendations.

Challenges

The client said that users struggle with many accounts and lack personalized recommendations for managing their finances. He wanted to create a solution that would give a full financial view, insightful analysis, and tailored advice to optimize budgets, savings, and investments. We developed a mobile app tailored to their needs.

Features

Our implemented features include the following:

- Data Aggregation and Visualization: This process combines information from different accounts and cards in one place, visually displaying expenses and income by category and period.

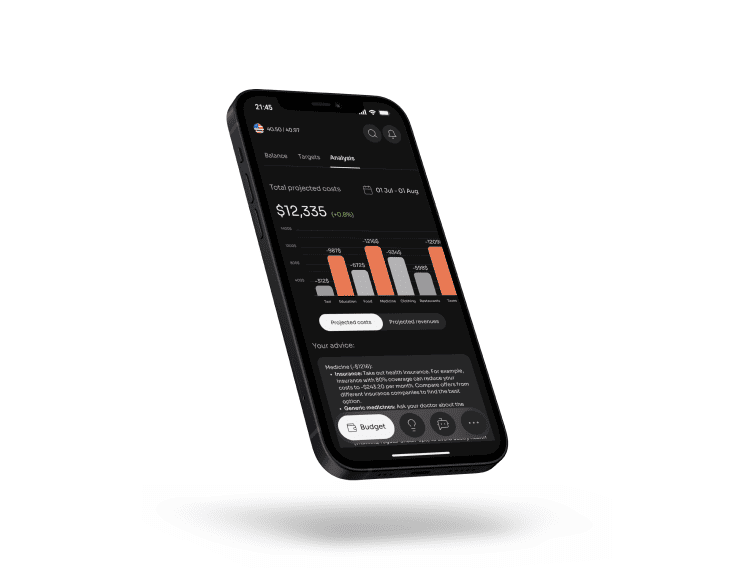

- AI Analysis and Personalized Recommendations: Automatically categorizes transactions, identifies financial habits, and provides personalized advice on optimizing spending, savings, and investments.

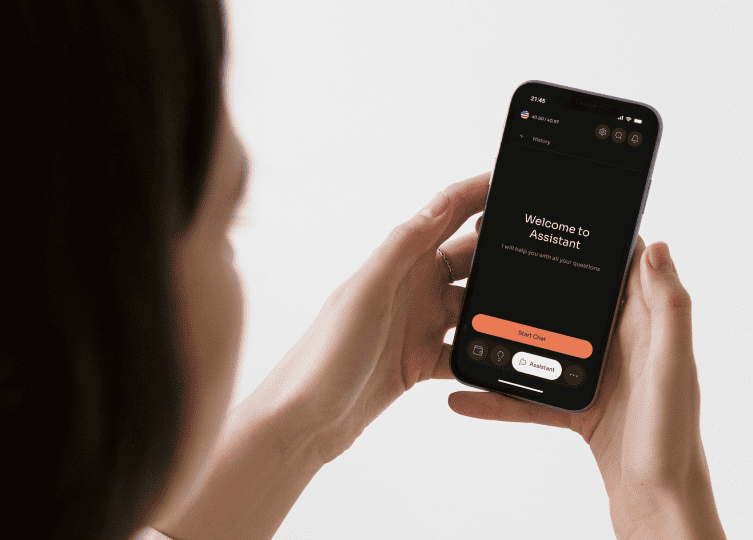

- AI Chatbot Assistant: Offers advice, answers questions, and helps resolve financial issues.

- Financial Forecasting: Predicts future expenses and income based on an analysis of previous financial activity.

- Payment Reminders: Sends timely notifications about upcoming payments and financial obligations.

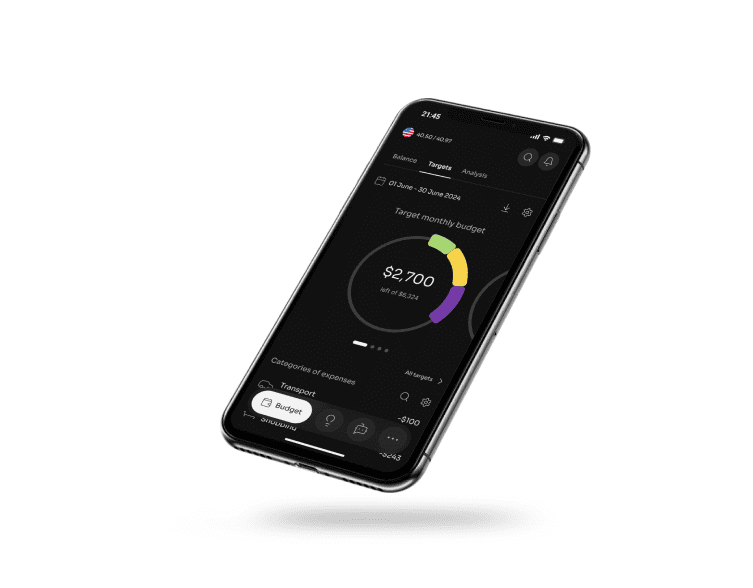

- Financial Planning Tools: Users can set and track financial goals, automatically calculating required savings.

Solution

Our team created an easy-to-use and effective solution to meet the startup’s needs. We collected all user data to give a complete view of their finances. Users can check their balances, review each card’s transactions, and track spending to find savings. With the Goals section, users can set and follow their financial goals.

Our AI provides customized advice for prudent financial decisions and goal success. It also examines spending habits, predicts future balances, and provides tailored advice.

The Tips section offers helpful financial advice based on users’ actions and goals. Users can customize their profiles and receive notifications. They won’t miss important financial updates.

We included interactive tips and reminders. These helped users access and act on personalized financial advice, ensuring a smooth experience.

Outcome

The client and their users greatly benefitted from our solution, which included:

- Users gain a comprehensive and clear view of their financial situation, enabling better financial management.

- Personalized, AI-driven recommendations help users optimize their spending and savings to achieve financial goals.

- The app’s forecasting and planning tools empower users to anticipate and prepare for future expenses and income.

- Interactive tips and educational features enhance users’ financial knowledge and decision-making skills.

- Users achieve greater financial stability and confidence with consolidated data and tailored advice.

Banking AI App users now wield powerful financial tools. Entrepreneurs streamline expenses while individuals pursue stability. The app’s insights empower all, from business owners to everyday savers, to take control of their money and make smarter decisions.