Background

Our client is a global e-commerce retailer operating across North and South America. For years, the business relied on a legacy platform to manage online sales, payments, and customer interactions. It was once effective, but time caught up. The system became slow, expensive to maintain, and difficult to scale. Integrations were limited. Upgrades were complex. Performance issues started to impact the customer experience. With growing demand and rising operational costs, it was clear: change was no longer optional. A modern, flexible solution was needed to support future growth.

Challenges

Dependency on Legacy Platform

The existing platform was deeply embedded in all operational processes, from order management to payment processing. Each customization required complex negotiations with the platform vendor and incurred significant costs.

High Operational Costs

The client was paying over $10,000 monthly just to maintain access to the platform, on top of expensive development fees for even minor adjustments.

Complex Payment Ecosystem

The client operated in 15+ countries, each with different preferred payment methods and regulatory requirements. Payments were handled through a tangled mix of direct integrations, third-party processors, and custom connectors to the legacy platform.

Fragmented Integration Landscape

The payment processing involved multiple players, including the legacy platform, a tokenization service, and numerous payment gateways. Ensuring seamless data flow and compliance across all these systems was a significant challenge.

Rigid Frontend & Content Management

The existing frontend was tightly coupled with the legacy platform. This made even simple content updates cumbersome, requiring developer intervention.

Features

- Integration with multiple payment providers, supporting both global and regional methods.

- Full migration to a modern, flexible CMS-driven frontend, enabling content updates without developer input.

- Re-architected payment flow, introducing a new middleware layer to handle payment initiation, tokenization, and result processing independently of the legacy platform.

- Performance optimization to handle high user traffic across multiple regions.

- Flexible localization support to accommodate content and payment variations across different countries.

Solution

Phase 1: Analysis & Planning

- We conducted a deep dive into the legacy platform’s architecture, identifying critical dependencies.

- Collaborated with the client’s internal team and their external development partners to map the entire payment and order management flow.

- Defined a phased migration plan, allowing business continuity while gradually replacing legacy components.

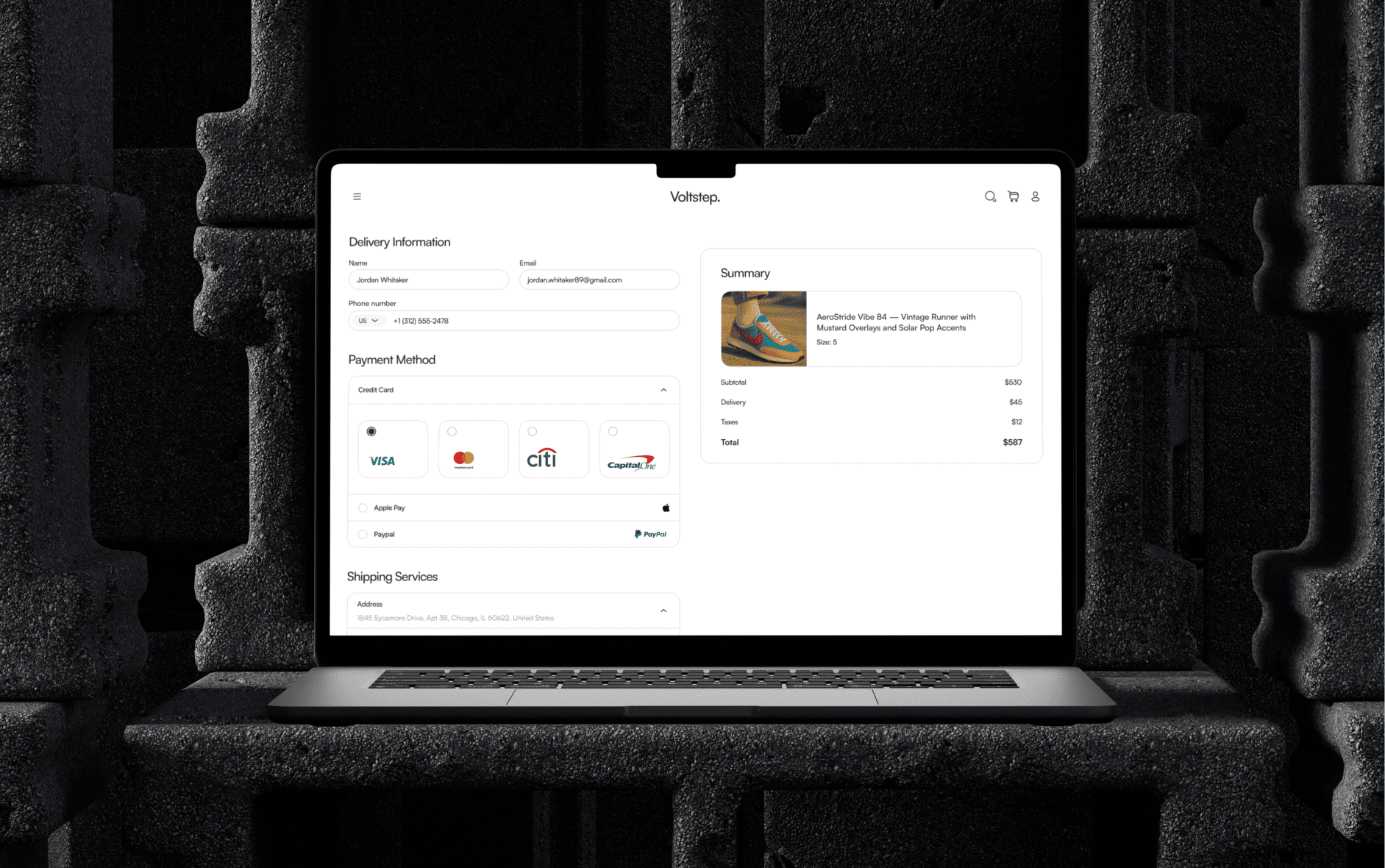

Phase 2: Building a New Front-end

- Developed a headless frontend decoupled from the legacy platform, powered by a modern CMS. This allowed the client’s marketing team to independently manage content across all markets.

- Implemented dynamic payment configuration, enabling administrators to add or modify payment methods without changing the code.

Phase 3: Payment System Overhaul

- Rebuilt payment processing using a flexible payment aggregation layer, which could support multiple payment gateways via a standardized interface.

- Introduced tokenization service integration, ensuring a PCI-compliant provider handled sensitive card data securely, reducing the client’s compliance burden.

Phase 4: Gradual Cutover & Parallel Operation

- Maintained partial integration with the legacy platform during the transition to avoid service disruption.

- Conducted extensive testing across all 15+ supported countries, ensuring localized payment experiences worked seamlessly.

Outcome

- Operational Cost Savings: 65% reduction in operational costs

- Future-proof Payment Ecosystem 3x faster time-to-market for new payment methods. 100% coverage of local payment methods across 15+ countries.

- Improved Performance & User Experience: 40% faster frontend performance across key regions.