Startup Funding: What It Is, How to Get Capital

Every startup begins with a dream, an idea that aims to shake up the market. But in the fierce world of business, just having a dream isn’t enough. It’s the power of funding that truly transforms a startup’s trajectory.

Take for example, Anthropic, a formidable rival to ChatGPT. Starting from humble beginnings, they secured a hefty $100M from big players like SK Telecom. Today, they’re valued at an astounding $1.6 billion, showcasing what’s possible with the right financial backing. And it’s not the only company, there are many other examples.

So, how do startups secure funding? Is there a secret formula for obtaining capital? In this article, we’ll demystify the process for you. We’ll not only guide you on how to get funds for startup endeavors but also introduce you to the various funding sources available.

What Is Startup Funding?

Startup funding is the financial boost that early-stage companies secure to fuel their launch, operations, and expansion. The startup financing is pivotal for startups, many of which lack the initial capital to cover essentials and scale effectively. To underscore its significance, in 2022 alone, the global startup funding from diverse sources surpassed $415.1 billion.

Best Practices for Raising Money for a Business

If you want to know how to get funding for a startup idea and raise capital for business expansion, starting on the right note is key. Here are some key considerations and best practices to point you in the right direction:

Create a Detailed Business Plan

Begin by crafting a detailed business plan that acts as a guide for potential investors. This plan should showcase your grasp of your target market, and unique value proposition. A strong business plan communicates your vision and builds credibility, demonstrating your preparedness and a clear path to success.

Look at Types of Funding

Once your business plan is in place, explore various funding avenues tailored to startups. These options include traditional routes like bank loans (often requiring collateral or a proven track record), angel investors, venture capitalists (suitable for high-risk, high-reward ventures), and crowdfunding websites (where small contributions from a broad audience can fund your project).

Explore Your Funding Options

Carefully assess your funding options to find the best match for your business. Each option carries specific requirements, repayment terms, and potential benefits. Thorough research and alignment with your long-term business goals and values are essential when making this decision.

Look for a Strategic Partner

Beyond securing funds, seek strategic partners who offer more than just financial backing. These partners bring industry knowledge, valuable connections, and insights to propel your business. Look for collaborators who share your vision and can contribute meaningfully to your growth and success.

Try to Minimize Initial Business Costs

Efficient resource allocation is vital for startups; therefore, look for ways to streamline business operations. For example, you can offshore software development services for startups instead of retaining an in-house team during the early stages. Also, negotiate favorable terms with suppliers and leverage technology for task automation and cost reduction. Minimizing initial expenses allows you to maximize your funding and extend your runway for success.

Create a Repayment Plan

Establishing a clear repayment plan is a crucial aspect of startup funding. It shows your commitment to financial responsibility and mitigates risk for investors or lenders. A repayment strategy also fosters transparency and builds stakeholder trust, laying the groundwork for future collaborations and investments.

How Startup Funding Works

When it comes to how to get your startup funded, it is essential to understand how funding for startup works, the different funding options, and the processes involved. Here’s what to know:

Types of Investors

Startup funding can come from various types of investors, each with its own objectives and expectations. Here are some common types of startup funding:

- Angel Investors

These are high-net-worth individuals and experienced investors who provide capital to startups, often in exchange for equity. This is probably the best way to get funding for a startup, but you must be careful about relinquishing too much control. Mark Cuban is one example of a well-known angel investor who has invested in startups like Otolith Labs. and Injective Protocol, although he passed on Uber.

- Venture Capitalists (VCs)

Venture capital firms pool funds from various sources to support startups with solid growth prospects. They offer substantial financial backing, often surpassing individual angel investors, and actively engage in the company’s development. For instance, Sequoia Capital, a renowned VC firm, has a track record of investing in major companies such as Airbnb, Google, and Apple.

- Corporate Investors

Corporate investors invest in startups to access innovative technologies, products, or markets. These strategic investors not only provide funding but also offer valuable industry expertise. Samsung’s investment in SmartThings, a startup backed by PayPal’s Max Levchin, is an example of corporate investment in a startup.

Types of Startup Funding

Startups can raise funds through various types of startup funding, depending on their stage of development and funding needs. Some common options are:

- Equity Funding

With equity funding, investors receive ownership stakes in the startup in exchange for their investment. This is common in angel investments, venture capital, and equity crowdfunding campaigns.

- Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow startups to raise funds from many individual investors. These investors contribute smaller amounts in exchange for rewards, equity, or early access to products. Oculus Rift, a virtual reality headset company, initially gained attention and funding through Kickstarter.

- Bootstrapping

Bootstrapping is self-funding a startup using personal savings, credit resources, or revenue generated by the business. This approach allows founders to retain complete control over their company but may constrain the pace and scope of growth.

Other options include bank loans, lines of credit, and financing by friends and family.

Startup Funding Rounds

Startups can raise funds through various types of startup funding, depending on their stage of development and funding needs. Some common options are:

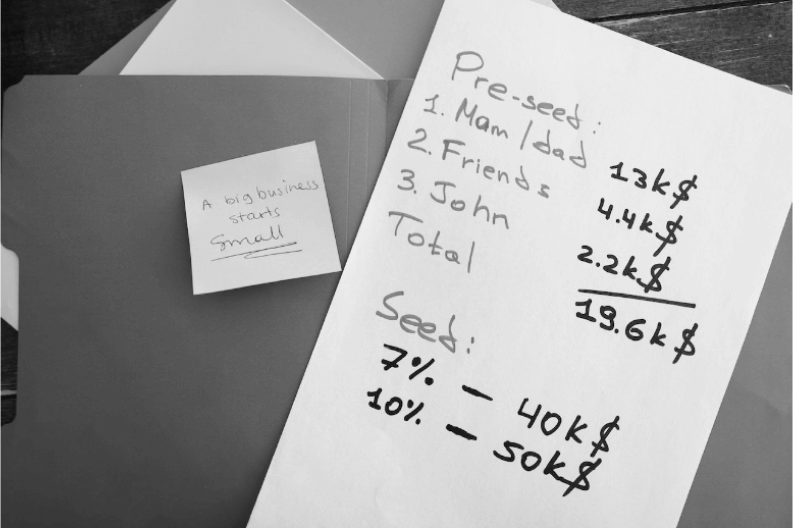

- Pre-seed Round

Pre-seed funding is the earliest stage of funding. It often validates the startup’s concept and builds a prototype or minimum viable product (MVP). This initial funding may come from the founders’ savings or small investments from friends and family.

- Seed Round

Seed funding is used to scale the startup’s operations, conduct market research, and do more product development. It can come from angel investors, seed-stage venture capitalists, or early-stage crowdfunding campaigns.

- Series A

Series A funding is typically raised when the startup has proven its concept, gained traction, and needs capital to expand rapidly. Venture capital firms often lead Series A rounds, and the funding is used to fuel growth and enter new markets.

- Series B, Series C, and Beyond

These funding rounds follow as the startup continues to grow. Series B and beyond involve more significant investments to scale the company further. Each round may involve different venture capital firms or strategic investors.

Best Startup Business Funding Sources

There are several funding sources for startup founders to get the financial assistance they need to launch and grow their businesses. Here are some popular options.

- Angel Investors:

Angel investors are professional investors who offer financial support to startups in exchange for equity or convertible debt. Their funding comes with valuable mentorship and industry insights, making them a prime resource for access to capital and tapping into their extensive network.

- Bootstrapping:

Involves using personal finances and business-generated revenue to fund a startup’s growth. While requiring careful financial planning, this method allows founders to maintain complete control over their business without taking on debt or diluting ownership.

- Business Lines of Credit:

Business lines of credit are flexible revolving credit accounts that offer funds up to a predefined limit. They serve well for startups requiring ongoing or unforeseen expenses. Typically, business lines of credit feature lower interest rates than business credit cards, making them a cost-effective financing option.

- Contests and Competitions:

Wondering how to find investors for a tech startup? Consider participating in pitch competitions like TechCrunch Disrupt, where you can showcase your business to potential investors and potentially secure cash prizes or investment capital. These events offer valuable exposure and networking opportunities, even if you don’t emerge as the winner.

- Corporate Partnerships:

Establishing partnerships with established corporations can strategically secure your startup’s funding, resources, and industry expertise. Collaborating with established firms can also open doors to new markets and customers.

- Credit:

Credit financing can be a good option for startup funding. However, it is essential to ensure that the repayment obligations are met when due to avoid accumulating excessive interest charges.

- Crowdfunding:

Crowdfunding sites have become increasingly popular for startups seeking funds and serve as an excellent meeting place for investors wondering how to find startups to invest in. Entrepreneurs can showcase their ideas on these platforms, attracting funding from a broad pool of individual investors.

- Equipment Financing:

When your startup demands specific machinery or equipment, consider equipment loans or financing. This option entails securing a loan or lease to acquire the necessary equipment, using it as collateral if needed.

- Friends and Family:

A common way to find investors for a startup business is to check within your immediate network. You can borrow money or receive investments from loved ones who believe in your business idea.

- Grants:

A business funding grant from government agencies, foundations, and private entities offers non-repayable funds based on specific criteria for your business’s nature or potential impact.

- Incubator or Accelerator:

Joining an incubator or accelerator programs can teach you how to get investment for startup companies and provide mentorship and valuable resources. Incubators are designed to nurture early-stage startups and help them develop into stable and sustainable businesses, whereas startup accelerators are geared towards startups already operational and looking for rapid growth and scaling.

- Investors:

Investors, including venture capitalists, angel investors, and crowdfunding platforms, offer capital in exchange for equity or ROI, making them potential funding sources for startups.

- Invoice Financing:

Consider invoice financing if your startup has outstanding customer invoices. This involves selling invoices to a third party for immediate cash, freeing up funds otherwise tied up.

- Keep Your Day Job:

Although not a conventional source of funding, keeping your day job provides a steady income to support your startup, alleviating immediate financial pressures as you gradually grow your business.

- Local Contests:

Many communities host business plan competitions or startup contests offering cash prizes and in-kind resources. Participating can provide both funding and exposure for your startup.

- Microlenders:

Microlenders specialize in providing small loans to entrepreneurs, particularly those who may not qualify for a traditional bank loan. These loan options are tailored for startups and small businesses seeking modest funding amounts. They have shorter payment periods and low-interest rates.

- Online Lenders:

Online lending platforms have become increasingly popular for business startups. They offer a streamlined loan application process, making it easier to secure necessary funds swiftly.

- Personal Loans for Business:

Financial institutions offer personal loans tailored for business purposes, ideal for funding startup ventures and addressing various business needs. Since it is a personal business loan, you are responsible for meeting the repayments and not the business.

- Personal Savings:

Using personal funds is a common funding choice for many startup founders (about 77%), enabling them to avoid accruing additional debt and maintain control over their business’s financial aspects.

- Private Equity Firms:

Private equity firms are investment companies that provide funding to startups in return for equity ownership. This source of startup funding is particularly suitable for businesses with high growth potential.

- Product Pre-sales:

Startups can raise capital by offering pre-sales of their products or services. This approach generates revenue before the official launch, supporting further development and production.

- Purchase Order Financing:

Particularly beneficial for manufacturing or distribution-focused startups, purchase order financing involves obtaining funds based on customer purchase orders. This facilitates order fulfillment and business expansion.

- SBA Microloans:

SBA (Small Business Administration) originally established to help minority business owners offer microloans to startups and small businesses ranging from $500 to $50,000. These loans carry interest rates of between 8% and 13% and do not exceed six years’ term lengths. They suit various needs, aiding working capital, inventory, and equipment. Ideal for startups with limited business credit history or collateral.

- Small Business Grants:

Grants are another excellent funding source for startups, and unlike traditional business loans, require no repayment. Governments, foundations, or corporations offer them to support specific industries or communities. Startups can tailor grants to fund research, marketing, hiring, and other needs. Examples include Small Business Innovation Research (SBIR) and the Small Business Technology Transfer Program (STTR).

- Small Business Loans:

Small business loans are traditional loans obtained from banks, credit unions, or online lenders. They provide funding in exchange for repayment with interest over a set period. Startups can use this option to finance operating expenses, equipment, and expansion, providing essential capital for startups.

- Strategic Partners:

Strategic partners are established businesses or individuals who invest capital, resources, or expertise in a startup in exchange for ownership equity in the company or access to the startup’s products or services. Strategic alliances bring financial support, mentorship, and credibility.

- Equity or Services:

Startups can creatively secure funding by offering services or equity to investors in exchange for money. So, if you’re wondering, “How can I find investors for my idea?” negotiate with investors for partial ownership or offer specific services like marketing, web development, or office space, especially when traditional financing options are limited.

- Venture Capital:

Venture capital can provide substantial funding to fuel rapid expansion. These investors provide funding to startups in exchange for equity or ownership stakes and often bring valuable industry expertise and connections. Ideal for high-growth companies in technology and biotech.

Which Type of Startup Funding Is Right for You?

As you can see, there are just so many funding options for startups. So, how do you find investors for startup ventures or determine the right funding for you?

Start by assessing your financial needs, business stage, and industry. For example, early-stage tech startups needing capital should consider equity financing like venture capital or angel investment. Established ventures seeking business cash flow or payroll support on the other hand, are better suited for standard business loans or alternative lenders, given their demonstrated longevity. Additionally, consider the option of outsourcing IT services for startups as a cost-effective alternative to maintaining an in-house team.

Be sure to seek financial and legal advice from experts, and don’t forget to consider the long-term implications of the type of funding you choose, including how they affect ownership and control. Ultimately, careful planning and research will help you make the best choice for the success of your startup.